In November of 2017, CASAA assisted ECigIntelligence in conducting a focused survey of vapers. The integrity of ECigIntelligence was verified, as was the purpose and scope of the survey, and the survey was circulated to our members via email.As a part of our diligence to our members, CASAA is publishing the relevant results to educate and advocate for our members.

Our members continue to provide some of the most comprehensive and meaningful information on vaping. We are grateful to everyone who took the time to help provide this information that can be used by CASAA and others in our advocacy efforts.

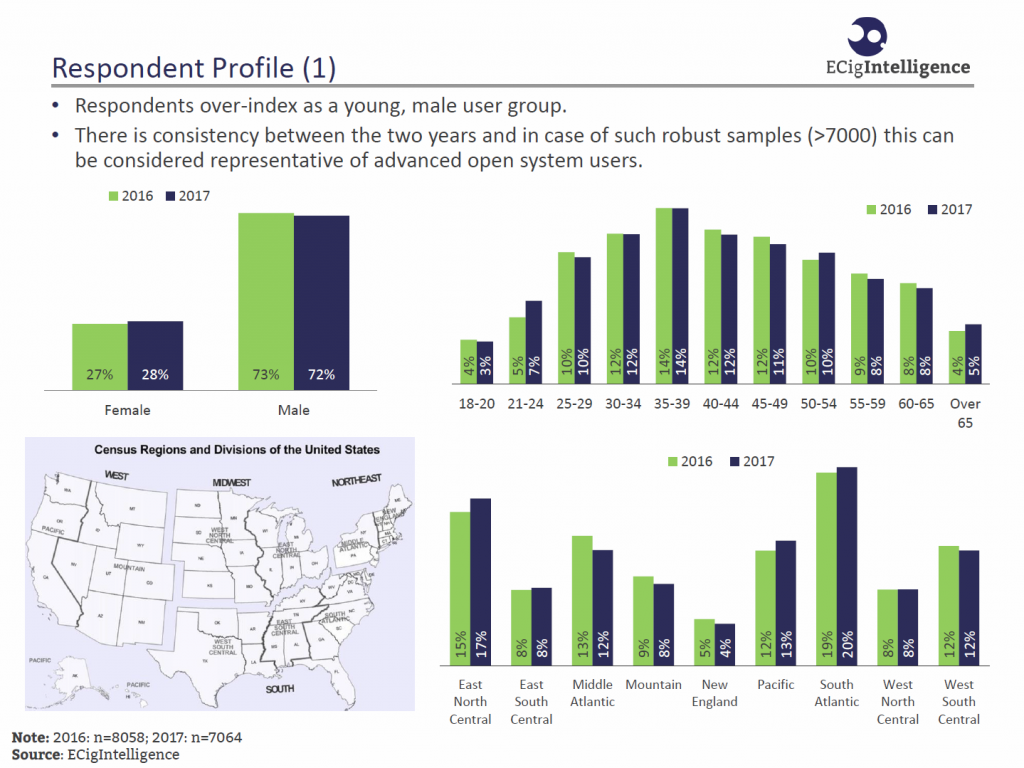

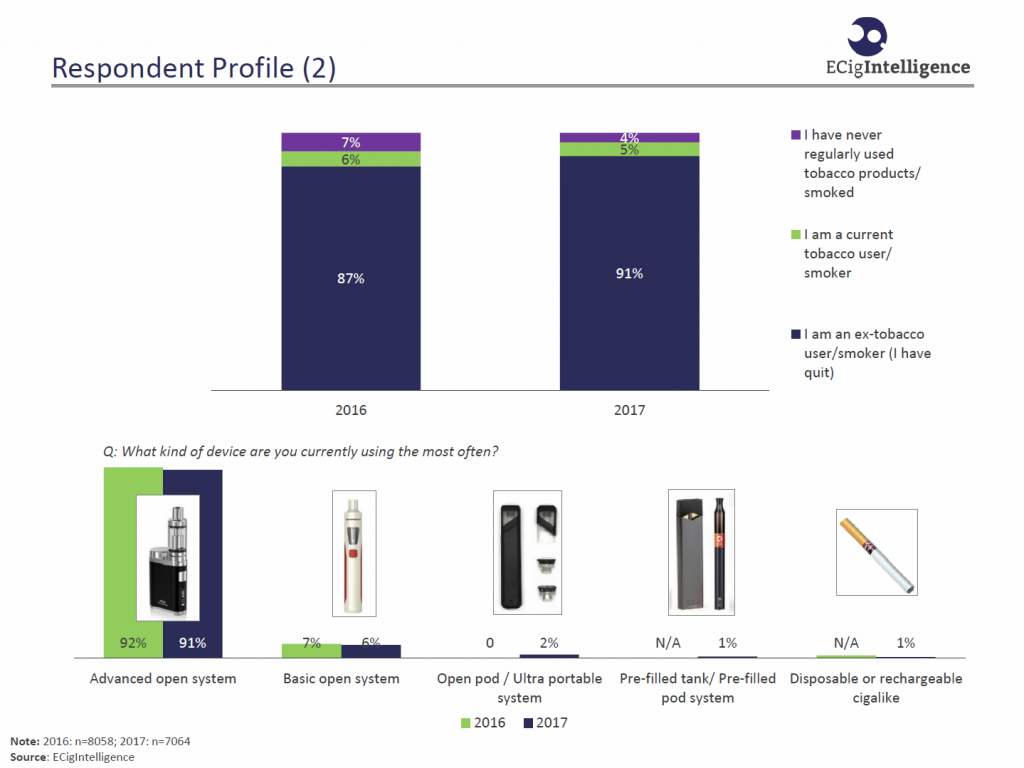

As in the previous year’s survey, the typical respondent was male around 35-39 years old. Young adults (18-24) made up only 10% of respondents. Those who took the survey were mostly advanced open-system users.

The trend between years shows a 4% increase in the number of respondents who consider themselves ex-smokers, while there is a 3% decrease in the number of non-smokers initiating vapor product use. The number of “dual users”, the majority of whom are transitioning from smoking to vaping, has remained steady. For 2018, the market segment was further refined and shows that the majority of respondents (97-99%) prefer basic open systems or advanced open systems. Also new this year is the addition of the Open Pod / Ultra portable segment, which accounts for half of the remaining users surveyed.

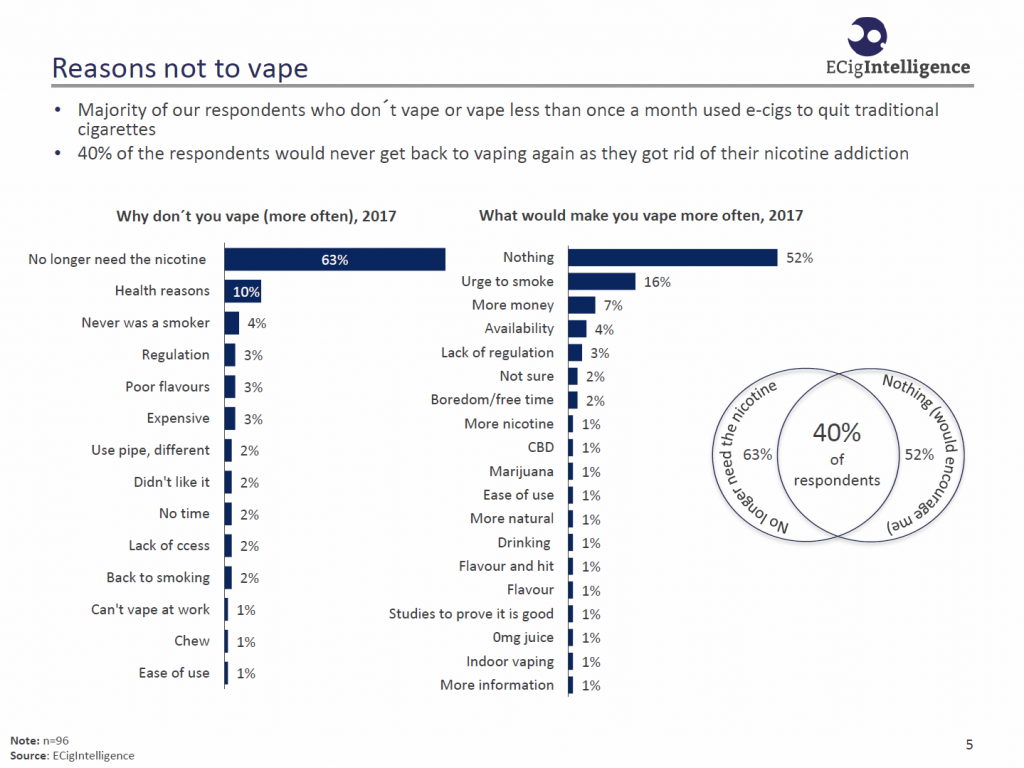

For 2018, the survey explored a key area of interest in usage patterns that had not been captured before – those users who stopped or dramatically cut down on use of vapor products. While understandably a small segment of the respondents (1.36%), it is an important element in the effectiveness of vapor products that often goes unnoticed. Of those respondents who vape less than once a month if at all, 40% would not go back to, or increase, vaping as they have successfully quit both smoking and nicotine dependence. Note that less than 2% of those who vape infrequently or not at all returned to smoking.

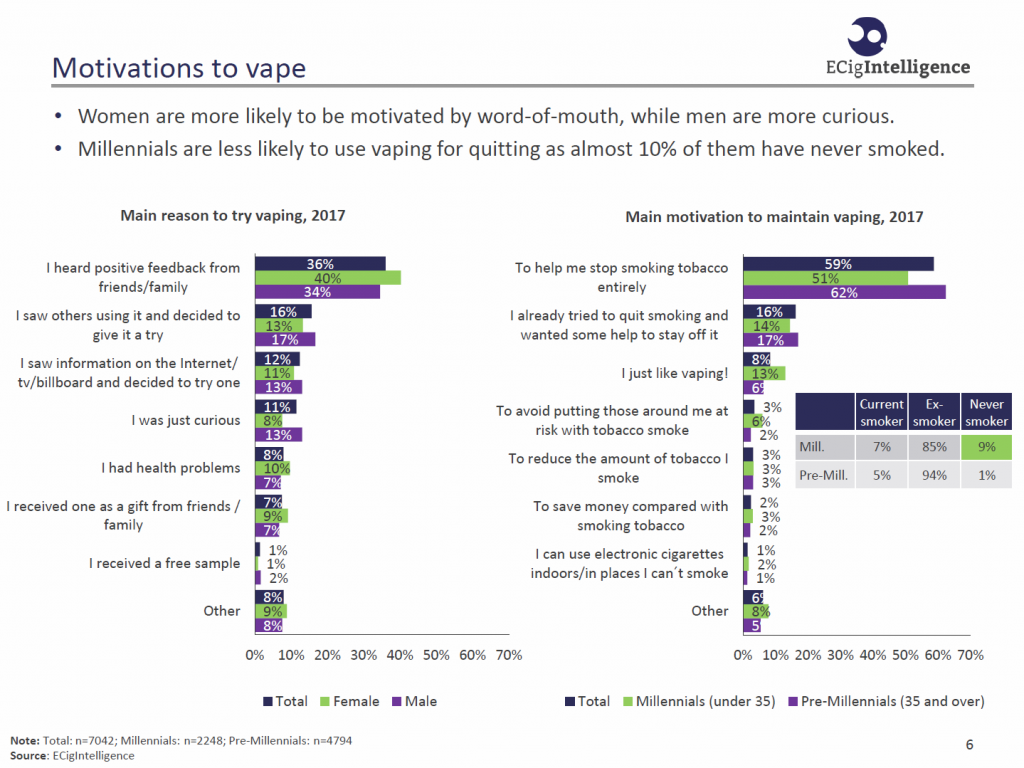

Countering the idea that advertising is attracting more users, key motivation to try vaping remains feedback from friends/family and seeing others using the products, accounting for 52% of the reasons given. The key reason to continue vaping is still to help stop smoking entirely or to remain smoke-free (75%).

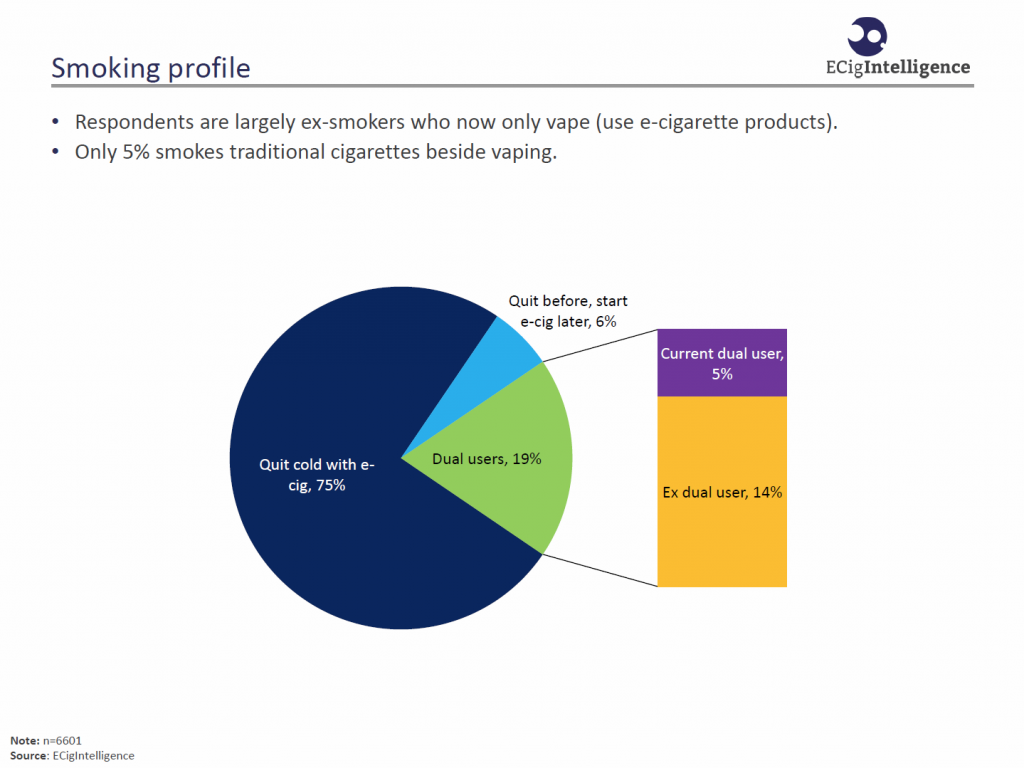

In this slide we see, once again, that the majority of vapers are ex-smokers (81%). Countering the argument that dual-use is growing, we also find that of the 19% who dual-use, more than 73% of them successfully transition from smoking to the exclusive use of vapor products.

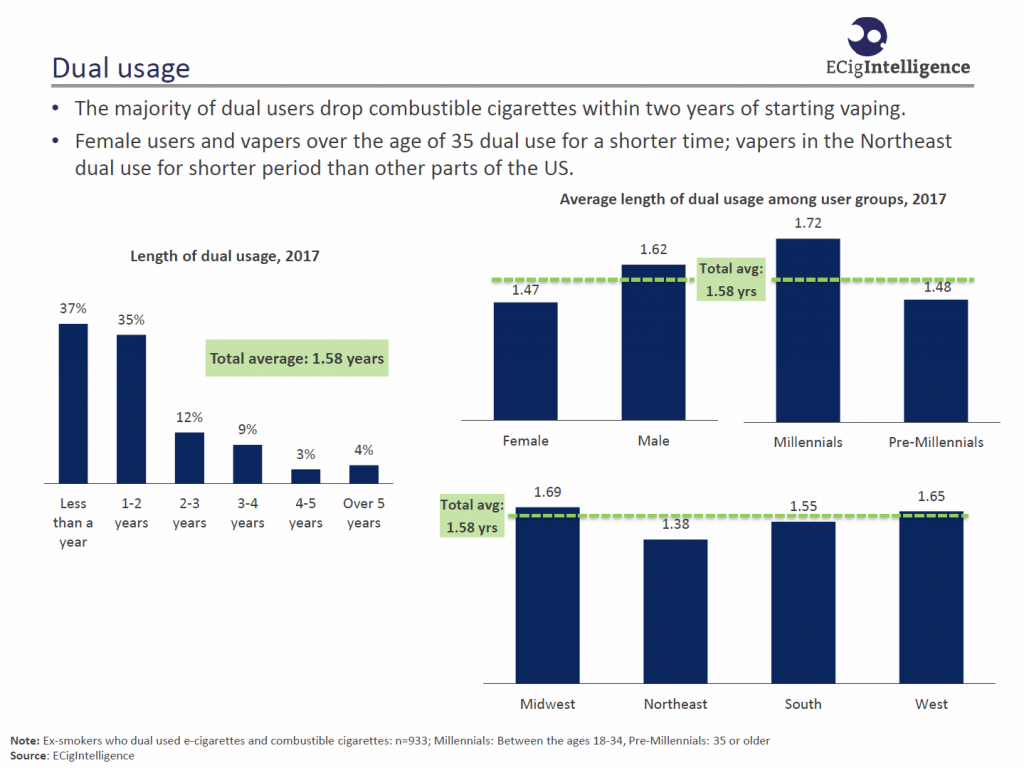

Exploring this transition from dual-use to exclusive-use, the average length of time before dual-use becomes exclusive-use is less than 2 years (1.58 years average). This phenomena remains fairly consistent across time, gender, age, and location, with only a 1-2 month difference overall.

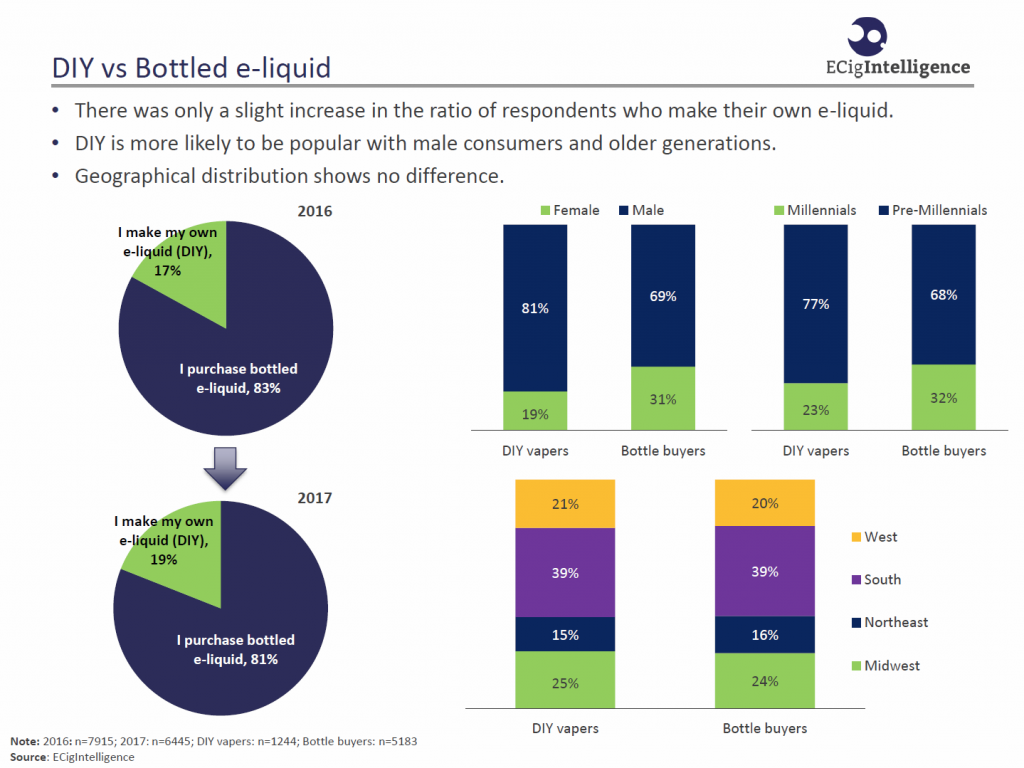

As potential regulation of nicotine and flavors looms, the survey takes a further look at the DIY market. While it is too early to identify clear trends, more than 1 in 6 of the vapers surveyed are creating their own e-liquids at home.

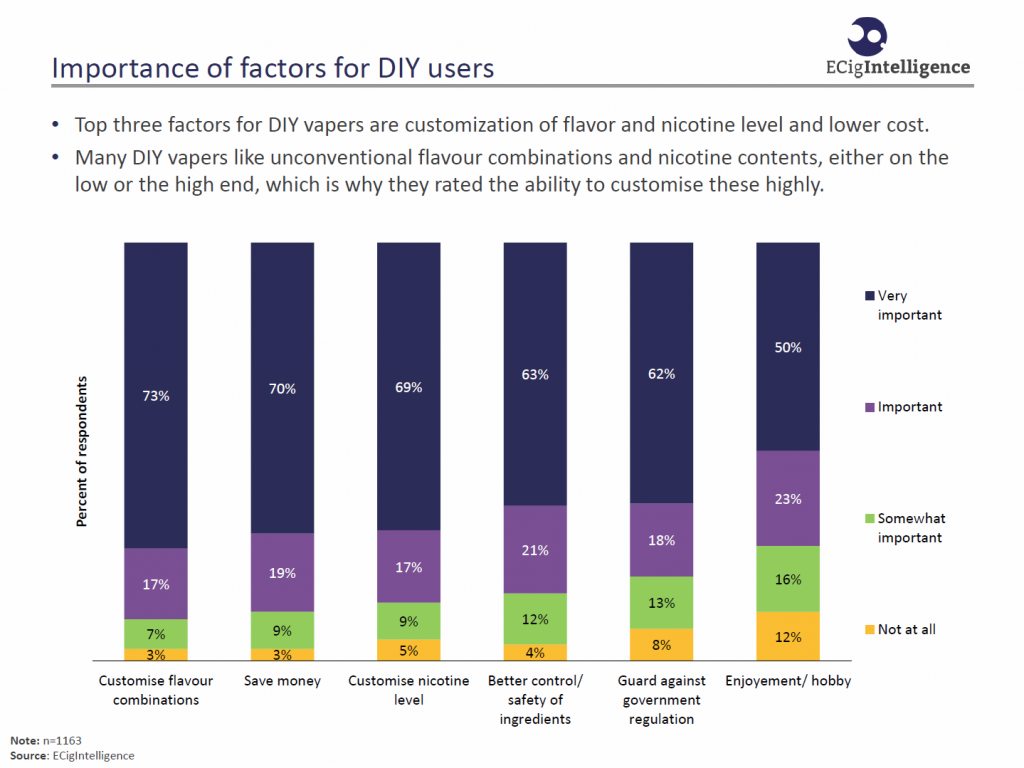

Key motivations for DIY vapers surveyed is the ability to customize flavors and nicotine strength and to save money. Notably, 80% felt that DIY was an important or very important safeguard against government regulation.

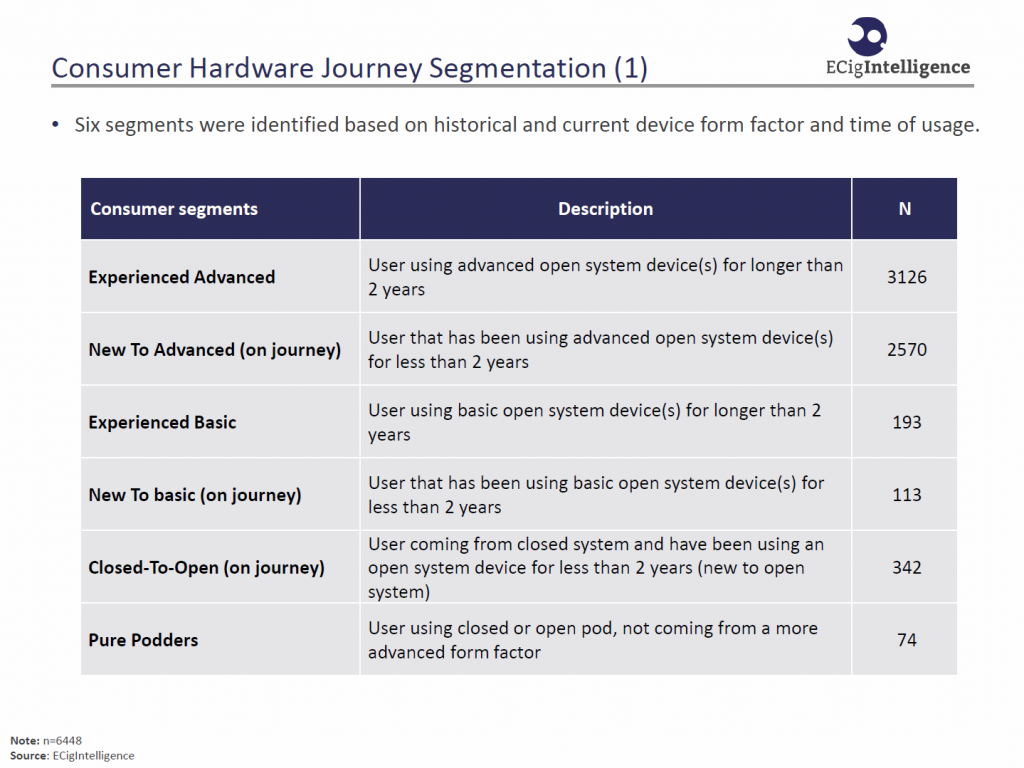

Exploring device usage a bit further, six segments have been identified. The majority of vapers (5,696 of 6,448 or 88%) were either new, or experienced, advanced-open-system users. Of the remaining 22%, the majority were on a journey from closed systems to basic open systems.

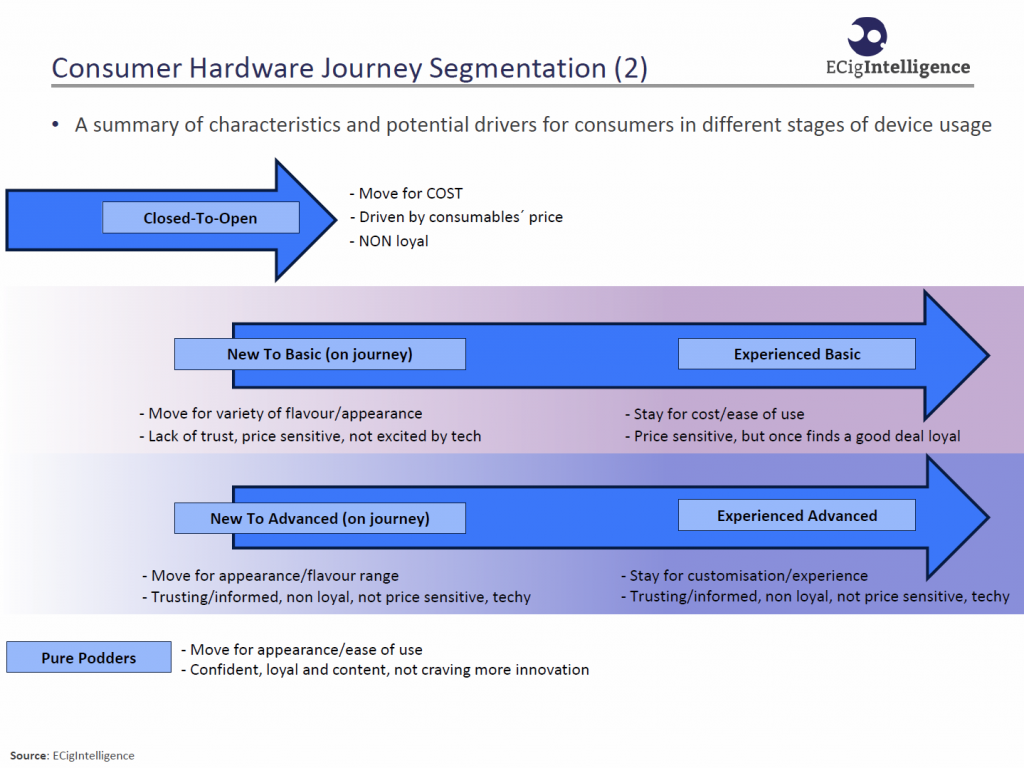

This last slide shows that there are key motivators in the journey to becoming an experienced vaper. Closed-system users typically find cost a sufficient motivation to move to open systems. For both the new-to-basic and new-to-advanced, the key motivating factor is the vaping experience (appearance/flavor), with the differences centering on cost/ease of use for experienced basic-system users, while experienced advanced-system users are motivated by customizing their experience.

CASAA thanks our members who took the time to answer the survey and ECigIntelligence for its work in providing this important data.

This article was originally published at CASAA

Author: Bruce Nye